Investors are always looking for an edge in understanding market movements, and when it comes to tech giants like Meta Platforms, Inc. (NASDAQ: META), staying updated is crucial. As a leader in social media, virtual reality, and the metaverse revolution, Meta’s stock performance is a hot topic. Platforms like FintechZoom provide real-time updates, actionable insights, and tools to help investors navigate the complex landscape of Meta’s stock.

In this comprehensive guide, we’ll dive into Meta stock news today, explore trends in the metaverse stock price, analyze historical performance, and look ahead to Meta stock predictions for 2025. We’ll also guide you through tracking Meta stock with FintechZoom, highlighting its benefits, tools, and resources for real-time updates.

What is Meta Stock?

Meta Platforms, Inc., formerly known as Facebook, is more than just a social media company. It’s a tech powerhouse shaping the future of communication and virtual interaction. Listed under the ticker NASDAQ: META, Meta is a major player in the stock market, often compared to other tech giants like MSFT stock (Microsoft) and NVDA stock (Nvidia).

Key Stats About Meta Stock (as of Today)

| Metric | Value |

| Ticker | NASDAQ: META |

| Market Capitalization | Over $800 Billion |

| 52-Week High/Low | $350/$160 |

| Revenue Sources | Advertising, Metaverse, AI, AR/VR |

Meta’s diverse business model encompasses:

- Advertising Revenue: Facebook and Instagram dominate digital ad spaces.

- Virtual Reality (VR): With Oculus headsets, Meta is a leader in VR innovation.

- Metaverse: A long-term investment in virtual worlds and immersive technology.

Why Meta Stock is Worth Watching

Meta is not just a stock; it’s a window into the future of technology. Its ventures into AR/VR, AI, and the metaverse make it a compelling choice for investors looking to stay ahead of the curve.

Why Choose FintechZoom for Real-Time Meta Stock Updates?

FintechZoom stands out as a trusted platform for Meta stock news today live and real-time financial data. Here’s what makes it indispensable for investors:

1. Real-Time Stock Data

FintechZoom offers live data, including the latest meta share price, trading volume, and intraday movements. Its accuracy makes it a go-to platform for traders and long-term investors alike.

2. Comprehensive Market Analysis

The platform provides deep insights into the Meta stock chart, historical trends, and expert analysis. This information is essential for predicting future performance.

3. Personalized Alerts

FintechZoom allows users to set custom alerts for specific stock price movements. For example, if the metaverse stock price hits a certain threshold, you’ll be notified instantly.

4. Expert Commentary

FintechZoom includes professional insights and predictions, such as Meta stock predictions 2025, giving users a well-rounded view of potential investment outcomes.

“FintechZoom combines technology and finance to deliver actionable insights for savvy investors.”

Meta Stock Performance Overview

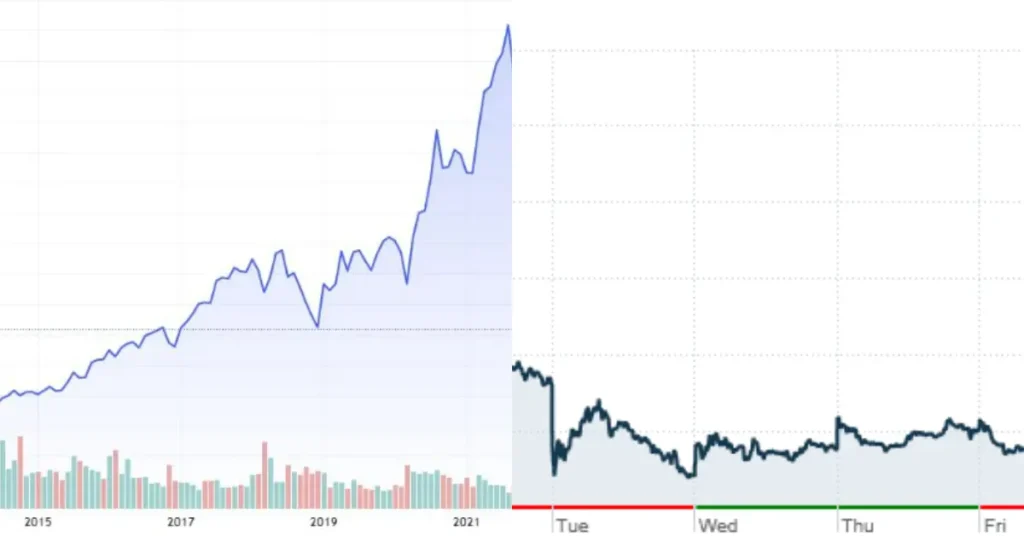

Recent Stock Performance

Meta’s stock has seen significant volatility, with key movements influenced by external factors like market trends and internal shifts such as product launches.

| Time Period | Meta Share Price (Average) |

| 1 Month | $300 |

| 6 Months | $270 |

| 1 Year | $320 |

Historical Trends and Key Milestones

- 2020-2021: Meta’s pivot to the metaverse led to significant rebranding and investments.

- 2022: Regulatory scrutiny impacted stock performance.

- 2023-Present: Innovations in AI and VR drove renewed investor interest.

Key Trends Driving Meta Stock

1. Advertising Revenue Growth

Meta’s ad ecosystem, powered by Facebook and Instagram, accounts for the lion’s share of its revenue. Its targeting capabilities keep it ahead of competitors like Snapchat and TikTok.

2. The Metaverse Revolution

Meta is investing billions in building the metaverse. With platforms like Horizon Worlds, it’s creating immersive spaces for social interaction and commerce.

3. AI and Automation

From content recommendation algorithms to ad optimization, Meta’s use of AI is transforming its business model and ensuring sustained user engagement.

4. Regulatory Challenges

Meta faces ongoing scrutiny over privacy and antitrust issues. These challenges could impact the meta shares price, particularly in the U.S. and European markets.

Opportunities and Risks for Meta Investors

Opportunities

- Expansion into AR/VR markets, capturing untapped potential.

- Increasing global user base, especially in emerging markets.

- Potential for growth in AI and automation technologies.

Risks

- Regulatory pressures and potential fines.

- Increased competition from tech giants like MSFT stock and NVDA stock.

- Economic factors affecting advertising budgets.

How to Track Meta Stock on FintechZoom

Step-by-Step Guide

- Search for NASDAQ: META or “Meta stock.”

- Access live stock charts, real-time prices, and historical data.

- Set up alerts for price changes.

- Bookmark the page for quick access to the latest updates.

Future Predictions for Meta Stock

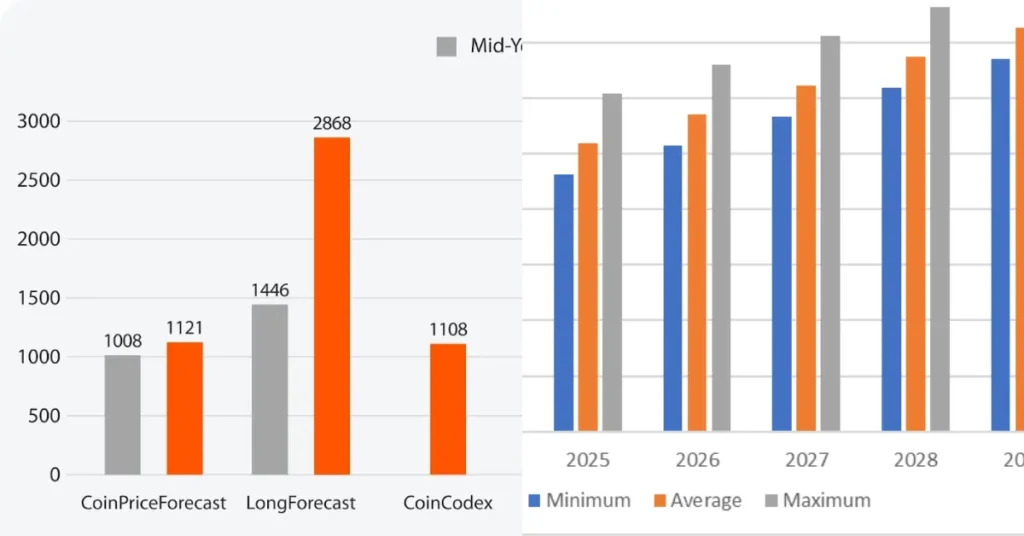

Analysts predict that Meta’s focus on the metaverse and AI innovation will drive growth in the next decade.

Meta Stock Predictions 2025

- Expected to grow 20-30% annually due to increased adoption of VR and metaverse technologies.

- Potential for new revenue streams in digital commerce.

- Risks remain from competitors like NVDA stock and regulatory challenges.

FAQs

What is Meta Stock?

Meta Stock refers to shares of Meta Platforms, Inc., the parent company of Facebook, Instagram, and WhatsApp.

What are the significant features of Meta Stock?

Key features include dominance in social media, advertising, virtual reality, metaverse innovation, and AI-driven solutions.

Who are Meta’s significant competitors?

Meta’s main competitors include Alphabet (Google), Microsoft, Apple, Amazon, and Snap Inc.

How do I track Meta Stock performance on FintechZoom?

Use FintechZoom for live stock quotes, historical trends, news updates, and custom alerts.

What are the benefits of investing in Meta Stock?

Benefits include strong market presence, diverse revenue streams, and cutting-edge innovation.

What are the risks of investing in Meta Stock?

Risks involve regulatory scrutiny, competition, and uncertainties in metaverse adoption.

What is the Meta Stock forecast from experts?

Experts predict long-term growth but advise caution due to potential short-term volatility.

Is Meta stock a good buy?

Meta stock is considered a good buy for long-term investors due to its strong fundamentals and innovation, but market volatility remains a factor.

How much is Meta stock right now?

Meta stock’s current price fluctuates; check live updates on platforms like FintechZoom or Nasdaq.

What is the target price of Meta?

Analysts project a target price range for Meta stock between $380 and $420 for 2024, depending on market conditions.

How much is Meta worth in 2024?

Meta’s market capitalization is estimated to exceed $1 trillion in 2024, driven by its metaverse and AI advancements.

Conclusion

Meta Platforms, Inc. (NASDAQ: META) remains a top choice for investors eyeing growth in the tech sector. By leveraging FintechZoom’s real-time tools, you can stay ahead of market trends, access critical insights, and make informed investment decisions.